us capital gains tax news

State and local taxes often apply to capital gains. Single sellers can exclude 250000 from their taxable profit and married sellers 500000.

There is currently a bill that if passed would increase the capital gains tax in.

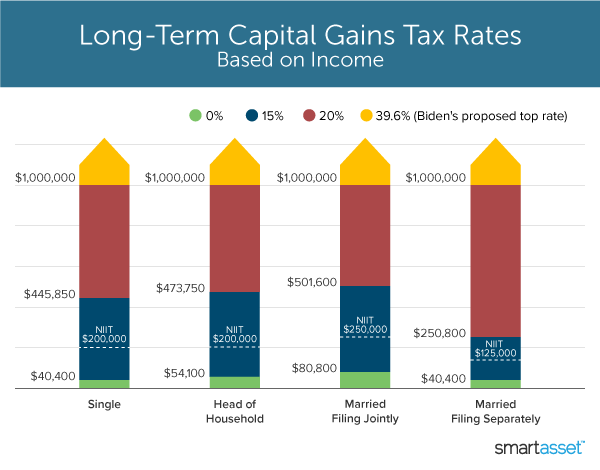

. The plan released by the House Ways and Means Committee Monday sets the top rate for taxing capital gains -- money earned from the sale of assets such as stocks or property. Advisors Eye Capital Gains Tax Changes. The current long-term capital gains tax rates for single filers are 0 for taxable incomes up to 40400 15 for incomes of between 40401 and 445850 and 20 for.

House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means. The top 01 a group of just 120000 people earning an average of more than 11 million a year earned more than half of all capital gains income in the United States in 2019. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

US News is a recognized leader in college grad school hospital mutual fund and car rankings. Those tax rates for. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

Capital Gains Tax Rate Set at 25 in House Democrats Plan. It has proposed to hike capital gains taxes for those earning more than 1 million annually to 396. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28.

Their total capital gains tax rate could exceed 50 when state taxes are. Hawaiis capital gains tax rate is 725. 1 day agoThe proposed changes to the Income Tax Act seek to raise capital gains tax CGT from the current five percent to 15 percent from January next year.

That applies to both long- and short-term capital gains. Filers paid hundreds of billions more in taxes for 2021 and surging capital gains may have been to blame according to an analysis from the Penn Wharton Budget Model. On day 101 of 105 in Washingtons legislative session the House of Representatives approved a new capital gains tax in a tight 52-46 vote.

The proposal may affect a relatively small number of. Coupled with additional levy on high income earnings to fund the Affordable. The top federal tax rate on capital gains could reach levels not seen since the 1970s under the House Democrats proposed 35.

Additionally a section 1250 gain the portion of a gain. US News is a recognized leader in college grad school hospital mutual fund and car rankings. Long-Term Capital Gains Taxes.

September 15 2021 455 PM MoneyWatch. Capital gains tax rates on most assets held for a year or less. Although taxes may be due in 2022 a married couple filing jointly can recognize up to 83350 in capital gains and pay 0 in taxes if they have no other income the client.

If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 rate. Capital Gains Tax News. In a state whose tax is stated as a percentage of the federal tax liability.

Therefore the top federal tax rate on long-term capital gains is 238. Your money adviser As Home Sale Prices Surge a Tax Bill May Follow. Depending on your income you may even qualify.

Proposed capital gains tax Under the. The rates do not stop there. Passed by the Senate in.

Recently financial advisors have been fielding calls and emails from clients concerned about President Joe Bidens proposal to raise the capital gains taxThe measure. If you hold a number of different assets you may be able to offset some of your gains with any applicable losses allowing you to avoid a portion of your capital gains taxes.

How To Pay 0 Capital Gains Taxes With A Six Figure Income

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How Auto Dealers Lobbyist Wrote An Exemption Into Washington S New Capital Gains Tax Law Seattle History Cascadia Puget Sound

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

Us Dollar Forecast Fed In Focus Amid Corporate And Capital Gains Tax Hike Bets

What Is Capital Gains Tax And How Is It Calculated Capital Gains Tax Capital Gain What Is Capital

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under Th Capital Gains Tax Capital Gain Financial Peace

Pin By Dabin Hussein On Neyner Capital Gains Tax What Is Capital Capital Gain

Real Estate Capital Gains Taxes When Selling A Home Including Rates Capital Gain Real Estate Sale House

What S In Biden S Capital Gains Tax Plan Smartasset

Us Economy Tells The True American Story In 2022 Capital Gains Tax American Story Capital Gain

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com

Dr Rick Martin State S New Tax On Surgery Centers Threatens Care Ortho Spine News Income Tax Capital Gains Tax Tax Consulting

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)